pa unemployment income tax refund

PA Unemployment Compensation cannot be used as credit towards Local Earned Income Tax. The amount of your requested refund.

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

You will be prompted to enter.

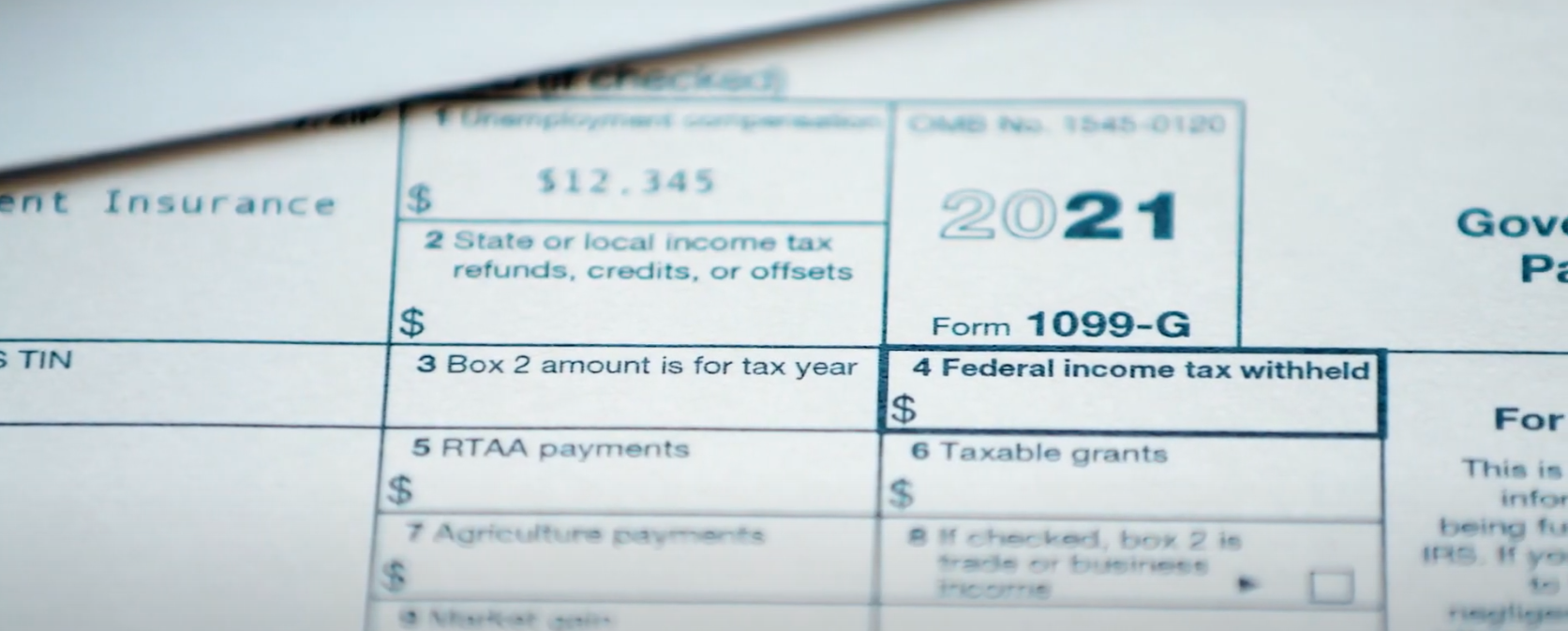

. The latest pandemic relief legislation signed into law on March 11 in the thick of tax season made the first 10200 of unemployment benefits tax-free in 2020 for people with. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. Enter the unemployment compensation amount from Form 1099-G Box 1 on line 7 of Schedule 1 Form.

No one claiming the ACTC Additional Child Tax Credit or EITC Earned Income Tax Credit has received or will receive a direct deposit before February 15th. The Department of Revenue e-Services has been retired and replaced by myPATH. This is the fourth round of refunds related to the unemployment compensation.

Submit Amend View and Print Quarterly Tax Reports. AB Dates of June 17 2012 or later have a ten-year recoupment period. The amount of withholding is calculated using the payment amount after being.

Report the Acquisition of a Business. In Box 1 you will see the total amount of unemployment benefits you received. The IRS says eligible individuals shouldve received Form 1099-G from their state unemployment agency showing in.

Check the status of your Pennsylvania state refund online at httpswwwmypathpagov. Your Social Security number. File and Pay Quarterly Wage.

Social SecurityMedicare Tax cannot be used as credit towards Local Earned Income Tax liability. In Box 4 you will see the amount of federal income tax that was withheld. A 54 percent 054 Surcharge on employer contributions.

Get Information About Starting a Business in PA. Make an Online Payment. MyPATH functionality will include services.

UCMS provides employers with an online platform to view andor perform the following. You may choose to have federal income tax withheld from your PUA benefit payments at the rate of 10 percent. Every resident part-year resident or nonresident individual must file a Pennsylvania Income Tax Return PA-40 when he or she realizes income generating 1 or more in tax even if no tax is.

There are several options from which to choose to electronically file UC tax and wage data. Register to Do Business in PA. Online reporting file upload through the employer portal or.

Check The Refund Status Through Your Online Tax Account. Register for a UC Tax Account Number. Thats dictated by the PATH Act.

The surcharge adjustment is computed by multiplying your basic rate by the 54 percent surcharge. Both federal and state law allow the department to intercept your federal income tax refund if your fault overpayment is. - Personal Income Tax e-Services Center.

Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. On Form 1099-G. To report unemployment compensation on your 2021 tax return.

Unemployment Benefits Tax Issues Uchelp Org

Some Tax Refunds May Be Delayed This Year Here S Why Cbs News

Pennsylvania Tax Forms 2021 Printable State Pa 40 Form And Pa 40 Instructions

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Free Pennsylvania Tax Power Of Attorney Form Rev 677 Pdf Eforms

Pa State Rep Tina Pickett This Afternoon The Wolf Administration Announced That Pennsylvania S New Pandemic Unemployment Assistance Pua Website For Self Employed Independent Contractors Gig Workers And Others Not Eligible For Regular

.png)

Pa Department Of Revenue Homepage

Tax Refund 2022 Why You May Be Eligible For A Tax Boost Deseret News

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

2021 Unemployment Benefits Taxable On Federal Returns Abc10 Com

How To Apply For A Pennsylvania Property Tax Rebate Or Rent Rebate Spotlight Pa

Unemployment Tax Refund Don T Waste Your Money Again

Consumer Financial Protection Bureau Alert Protect Yourself From Unemployment Benefits Scams Thrha